LESSON 4

OVER PRODUCTION AND EXCESS CAPACITY

Over production refers to a situation where a firm or industry produces goods and services (output) in excess of demand.

While

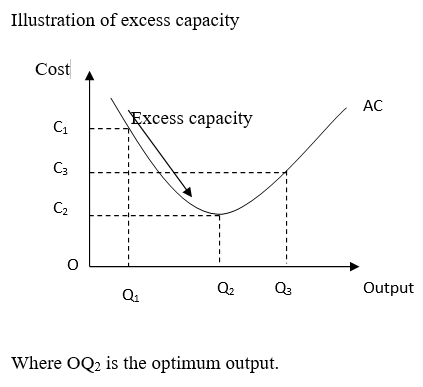

Excess capacity refers to a situation where a firm or an industry produces output at less than installed capacity (or at less than optimum level of output).

Causes of excess capacity

- Low level of technology.

- Limited basic raw materials for production.

- Poor infrastructure such as poor roads.

- High costs of production such as due to high taxes.

- Limited entrepreneurial ability.

- Political instabilities in some areas, causing uncertainty among producers.

- Desire for high profits by entrepreneurs.

- Limited skilled labour.

Solutions to production at excess capacity

- Improvement in the level of technology.

- Development of infrastructure such as power dams.

- Expansion of market size through market research.

- Training of labour to acquire entrepreneurial skills.

- Reduction of taxes on companies by government.

- Controlling monopoly tendencies such as by reduction of patent rights given some producers.

- Offering more credit facilities to producers (loans).

MERGING OF FIRMS

Merging refers to the coming together of two or more firms to form one bigger firm.

Forms of merging

1. Horizontal merging

Refers to the coming together of two or more firms in the same industry at the same level/ stage of production to form one big firm/ to enjoy economies of scale.

For example, merging of two restaurants, merging of two saloons

2. Vertical merging

Refers to the coming together of two or more firms in the same industry but at different levels / stages of production to form one bigger firm.

For example, merging of a firm making raw materials and a firm processing raw materials – merging of a tea growing firm and a tea processing firm, merging of a sugarcane firm and a sugar factory.

Types of vertical merging include:

1. Backward vertical merging— is where a firm joins together with another firm at the previous stage of the production process (towards the source of inputs).

OR refers to a situation where a firm at a higher stage of production combines with another at a lower stage of production.

For example, a furniture making firm joins with a timber supplying firm, a tea processing firm joins with a tea growing firm.

2. Forward vertical merging—is where a firm joins together with another firm at the next stage of the production process.

OR refers to a situation where a firm at a lower stage of production combines with another at a higher stage of production (with the aim of securing market for its output).

For example, a furniture -making firm joins with a furniture retail shop, a tea processing firm joins with a tea distribution firm, a grain milling firm joins with a confectionary firm.

3. Lateral merging

Refers to the coming together of two or more firms in the same industry but are not competing with each other.

(OR This is where two or more firms which produce related commodities that can be marketed together join to become one firm).

For example, merging of shoes and shoe polish making firms, merging of blazer/jacket and shirt making firms, merging of a firm producing torches and another firm producing dry cells, a car selling firm joining with a firm dealing in car tyres.

Lateral merging is mainly aimed at serving a wider market for the products and to avoid dependence on a particular product.

4. Conglomerate merging (diversified merging)

Refers to the coming together of two or more firms in completely different industries (producing unrelated commodities). For example, a restaurant merges with a studio, a dry cleaner merging with a stationary shop.

Advantages of merging /integration of firms

- Merging reduces /controls unnecessary competition and duplication of products. This in turn reduces wastage of resources such as costly advertising and sales promotion. (Increases monopoly power and associated advantages).

- Merging improves efficiency in management. The less efficient firm merges with a more efficient firm, and this improves management of the created firm. More so in the new firm more efficient workers are employed.

- Reduces competition for market and in turn expands market for output. This is because a few large firms remain in production.

- Merging promotes research. This is because the merged firms combine resources to finance the needed research, hence increasing productivity.

- Merging accelerates the rate of innovations and inventions because of combining ideas. This in turn leads to increased output/sales and profits.

- Reduces competition for raw materials and this is because the firms have a common source of raw materials. This promotes the level of production/output.

- Easy mobilization of capital foe business/ increases access to loans from financial institutions. This is because financial institutions easily give money to large firms due to having collateral security (many assets). More so merging enlarges the pool of capital for business expansion.

- Promotes efficient utilization of resources. There is optimal production due to reduced average costs of production such as due to combined management (and reduced number of workers).

- Promotes backward and forward linkages in production especially with vertical merging. Some firms merge with raw materials supplying firms and others with market providing firms.

- Ensures long run survival of a firm by expanding investment for example the case of conglomerate merging. The firm gains more assets to facilitate in expansion and performance in the market.

- Merging enables the firm to access better technology. Due to more funds available, the firm acquires more efficient/ appropriate techniques by purchasing or research, which in turn increases productivity.

Disadvantages of merging/ integration of firms

- Merging leads to loss of efficiency in the long run. Management becomes complicated, there is bureaucracy /long chain of command leading to delayed decisions making (due to increased scale of production).

- Reduces employment opportunities/results into unemployment. During merging restructuring of management takes place and hence some workers lose their jobs.

- Causes conflicts in administration. There are problems during staffing such as choosing the top managers leading to misunderstandings/ hatred.

- Enhances over production due large-scale production and hence wastage of resources. This is especially due to small market size.

- Large firms attract government attention such as by imposing higher taxes on them to raise more revenue. This reduces the profit margin.

- Creates monopoly tendencies with their disadvantages such as over exploiting consumers by charging high prices and production of poor-quality products.

- One firm may absorb the liabilities/ debts of another firm. This slows down the progress of the new firm which has to first clear the outstanding debts and after embark on further investment.

- Over expanding of the firm results into diseconomies of scale—disadvantages of large-scale production such as managerial and technical diseconomies.

- There are difficulties of valuing assets of the firms before merging takes place. This leads to undervaluation or over valuation of assets, hence a potential source of conflicts in future.

- Leads to over exploitation of resources due to large-scale production. This in turn leads to quick depletion of some resources or raw materials.

- Leads of loss of independence and identity of certain firms. Some firms disappear completely after merging.

Limitations to merging/integration of firms

- Long distance between firms. Firms that are far apart are difficult to combine since this increases administration costs.

- Small market for certain products. This makes the owners of the firms reluctant to enter into mergers since the market for increased output is not assured.

- Fear of high taxation by government. Large firms attract government attention in form of increased taxation and this reduces the profit margin.

- Government policy of restricting merging as a way of controlling monopoly. The government is interested in promoting production of quality output and at reasonable prices, which is possible with many firms in the economy.

- Fear of management problems/ complexity in management due to over expansion. As the scale of production increases, management becomes more difficult, leading to delayed decision making.

- Fear of unemployment that results from merging. The employees of these firms resist integration since some of them stand to lose their jobs during restructuring the firm after merging.

- Fear of absorbing the liabilities/ debts of another firm. The efficient firms fear taking on responsibilities that are not directly made by them such paying outstanding debts of one firm.

- Fear of loss of independence in management and control of firms. For example, as a family-based business integrates with another firm the role of family members in the running of the business reduces.

- Inadequate supply of skilled manpower required by large firms. It becomes increasingly difficult to acquire skilled personnel/ manpower capable of running such expanded businesses, and this undermines productivity.

- Fear of losing touch with customers. Some firms lead to personal or direct contact or relation with the customers such as for goods for special order, and this is lost with merging.

- Differences in the level of technology employed by the firms. The varying methods of production make the different firms difficult to combine since at times it requires completely changing one of the firms, which is costly.

- Differences/variation in the aims and objectives of the firms. Some firms are majorly interested in maximizing profits while others majorly aim at maximizing sales which objectives are conflicting and this hinders merging.

- Production of unrelated commodities/ variation in the type of products of firms (firms being in unrelated fields). It is difficult to combine unrelated assets or firms which require different raw material inputs or those which no linkage (of market or raw material) at all.

- Fear of diseconomies of scale due to over expansion of the firm. Merging leads to large-scale production, which leads to increased average costs such as managerial diseconomies.

Guiding questions

- Outline the advantages and disadvantages of horizontal merging of firms.

- Mention the reasons for merging /integration of firms in an economy.

- Give the advantages of backward and forward merging of firms.